How to hack growth like Revolut (the secret is mobile app engagement!)

Revolut is changing banking for the better

As the digital generation matures, neobanks such as Revolut will continue to grow. Today, almost 1 in 2 people use digital banks exclusively. That’s up from 1 in 4 in 2013. This growth is particularly concentrated in young people, where over 80% of 18-25-year-olds use mobile banking! Given this, Revolut saw how crucial mobile app engagement is now, and how critical it will be to guarantee future success.

Initially, Revolut was created to allow customers to avoid transaction fees when traveling abroad. In today’s interconnected world, with more being spent by international tourists each year, Revolut saw a growing customer need and satisfied it. Now, though, Revolut wants to get more out of its existing customers. As an illustration, from 2018 to 2019, user numbers doubled. However, Revolut’s profit margins tripled!

The company achieves this with mobile app engagement that keeps people glued to the app. Revolut boasts 1.1 million daily users – and an active user offers more touchpoints for the company to connect. In addition, loyal users will spend up to 30% more than average users and are more likely to become brand advocates. In turn, customer advocacy will lead to more effective user referrals. That’s the answer to becoming the fastest-growing tech company in Europe!

3 steps to turn mobile app engagement into growth

For Revolut’s fast-growth strategy to be successful, it was imperative to create a highly engaging app. Rather than investing its budget in marketing, Revolut preferred to invest in its product and rely on user referrals to grow instead.

The thinking can be summed up in 3 easy steps:

- Make an exciting app with gamification examples like point systems.

- Motivate daily user activity and turn them into customer advocates.

- Incentivize user referrals, led by your loyal customers!

Why is this so successful? User referrals are the most valuable form of marketing! Referrals are achieved by creating loyal customers, which are formed by a fun and satisfying app that keeps users engaged!

Revolut further encourages user referrals by exploiting the ‘network effect’. Essentially, the service becomes more useful the more people use it. For example, features such as bill splitting or shared saving vaults encourage users to persuade their friends to join. These features will give users a purpose, or an ‘extrinsic motivation’ to use the app.

However, to create long-lasting customer loyalty, you need to harness intrinsic motivation. This is when the app is naturally fun to use. One of the best ways to create this is with gamification.

Since Revolut started in 2015, dozens of studies have examined the benefits of gamification. Consultancy firm Optimove found that gamification can boost engagement by as much as 30%. In turn, and this is important for achieving referrals, gamification results in a 22% increase in customer loyalty! By keeping users active, Revolut managed to sustain affordable and fast customer growth and won the place of Europe’s biggest neobank.

Changing user behavior is hard. To make it work you need a deep understanding of what motivates your user to keep going forward. Luckily for you, our team of gamification experts already did the hard work! Even better, we put it into a workshop packed with foolproof ways to make gamification work for you!

5 gamification examples that boost the user experience

So you already know why you need an engaging app. But how do you actually go about building it? Let’s take a look at 5 gamification examples that make Revolut so amazing to use!

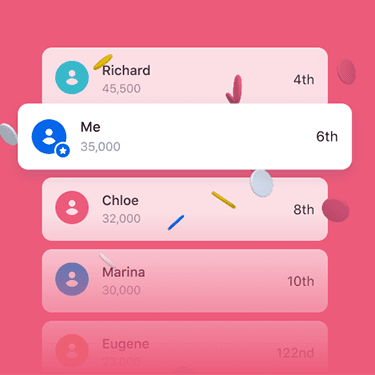

#1 A points system rewards user loyalty and creates a fun competitive dynamic

Revolut combines 3 powerful gamification features into one. Users get to collect points for being active on the app. As their points increase, so does their ranking on the leaderboard. The higher ranking also gives them a higher chance of winning actual cash prizes!

Additional incentives that boost user ranking include referring friends (a priority for Revolut, as established), and completing in-app challenges. While the £250,000 prize pool acts as an extrinsic motivator that guides user need for purpose, the leaderboard taps into intrinsic motivation by making the competition fun. The excitement is enhanced with falling coins that act like digital confetti.

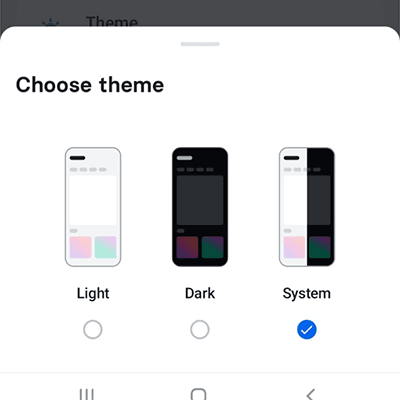

#2 Customization tools like personal avatars and theme selection give users control

Letting users choose a theme and personal avatar is more powerful than it may appear. Not only does customization harness the need for control, but allowing users to make the interface their own also makes them more hesitant to abandon it. After all, it’s their own space! Studies have found that custom avatars significantly improve a sense of ownership. This is how you create an immersive and sticky user experience.

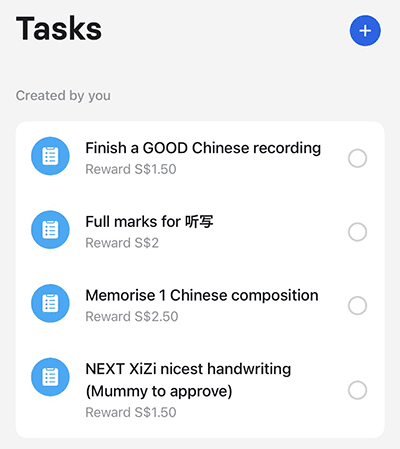

#3 Gamified tasks help junior accounts shape the right behaviors

Intended to help 7 to 17-year-olds learn good financial habits, Revolut Junior gamifies tasks set by parents to motivate the young users to complete them. After finishing a task, the young users get money transferred to their account to spend as they wish. Aside from the obvious motivator of a cash reward, this feature satisfies a core motivational need for control and empowerment.

The junior user can choose what tasks to do and when! Gamification is a core element of what makes the Junior account work so well. In fact, research shows that gamification is especially powerful for young learners. Since young people make up the largest share of digital bank users, it is smart that Revolut is targeting them with Junior accounts.

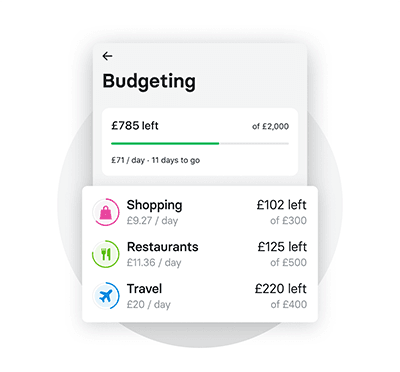

#4 Progress bars push users to save up a nest egg

In order to encourage either frugal spending or rainy day savings, a progress bar shows how close you are to your limit or goal. Users can set their own targets, making the app feel more personal. They also get to see a clear transaction history to get insights into their spending habits. It cannot be overlooked that knowledge is an important intrinsic motivator!

By visualizing progress, users can see how much time and effort they still need to allocate. Additionally, the progress bar provides instant gratification and triggers a natural motivation for progression. Crucially, this feature creates active and loyal users. Customers will use Revolut every time they spend if they wish to keep accurate records!

#5 Tiered loyalty programs reward app engagement and create customer advocacy

A tiered rewards program creates a hierarchy of users similar to a leveling system. This has wide-ranging benefits. In fact, consumer research finds that 75% of people like to associate themselves with a brand that offers loyalty program rewards. Put simply, people like to be rewarded with tailored and relevant perks.

Why should users engage more with your app, if the rewards don’t recognize the extra effort? In gamification lingo, this means harnessing the constraint mechanic. In other words, certain elements are locked off and must be earned or bought. The instant benefits gained in a tier system are shown to increase user enrollment and builds customer advocacy.

In short, Revolut has learned from classic gamification examples like rewards systems and smartly adapted them for the Fintech context. The results are clear – in the first quarter of 2021 revenue grew by 130% and that rise will likely continue! User-friendly apps are the future standard of finance, and Revolut’s fast growth is a testimony to that.

Recap

Fintech companies are upending banks as we know them. Digital banking is growing 3 times as fast as traditional banks. The clear leader is Revolut – the fastest-growing tech company in Europe!

Revolut is changing banking for the better

Today, almost 1 in 2 people use digital banks exclusively. That’s up from 1 in 4 in 2013. This growth is most visible in young users, where over 80% of 18-25-year-olds use mobile banking! Given this, Revolut chose to focus on mobile app engagement.

The results speak for themselves. From 2018 to 2019, the number of Revolut users doubled. However, profit margins tripled! The company achieves this by with more engaged, more loyal customers, and in turn, who refer more friends.

The 3 easy steps of how mobile app engagement creates growth

This is clearly illustrated in the 3 step expansion strategy for Revolut:

- Make an exciting app with gamification examples like points systems.

- Create daily active users that become customer advocates.

- Incentivize user referrals, led by your loyal customers!

Why is this so successful? User referrals are the most valuable form of marketing! It is a fact that 92% of people trust referrals from friends and family. These referrals are earned by people who enjoy using the app – something achieved with gamification.

Consultancy firm Deloitte found that gamification can boost engagement by as much as 40%. In turn, and this is important for achieving referrals, gamification results in a 22% increase in customer loyalty! This is the secret to a growing and active userbase.

5 gamification examples that boost the user experience

- A points system rewards loyal users and creates fun competition.

- Customization tools like avatars and theme selection give users control.

- Gamifying tasks incentivizes Junior account holders to achieve.

- Progress bars push users to save up a nest egg.

- Loyalty programs reward app engagement and create customer advocacy.

In short, Revolut has smartly adapted gamification for a Fintech context. The results are clear – in the first quarter of 2021 revenue grew by 130% and that will likely continue!