How better experiences will be the most powerful move for banks

How better experiences will be the most powerful move for banks

TL;DR: In 2026, the competitive landscape for financial institutions has shifted from interest rates to interface quality. Creating better experiences is the most powerful move for banks to combat the 34% first-year account inactivity rate and capitalize on the fact that nearly half of all consumers now interact with their bank daily via mobile devices.

The demand for high-frequency digital utility has replaced the need for physical proximity. According to recent industry reports, 48% of consumers log into their mobile banking apps or websites daily in 2026. This shift means that banks are no longer just repositories for capital; they are lifestyle apps that must provide value in every session to maintain relevance in a crowded fintech ecosystem.

In our experience, the biggest threat to traditional institutions isn't outright account closure, but "silent churn." Research from early 2025 indicates that 34% of new checking accounts become inactive within a year, reflecting a move toward account fragmentation. To survive, banks must move beyond basic transactions. Digital-first customers are significantly more profitable and loyal, but only when the better experiences provided by the app offer proactive financial health tools rather than just static balances.

So how can banks create digital experiences that stand out and create loyal customers at the same time? Here’s what we’ll cover:

- The loyalty problem for banks

- What are banks doing to improve customer loyalty?

- Gamification for apps & how it fuels customer loyalty

- Banks that have crushed it with gamification

- A gamification tool that boosts app engagement & customer loyalty

The loyalty problem for banks: Why better experiences are essential

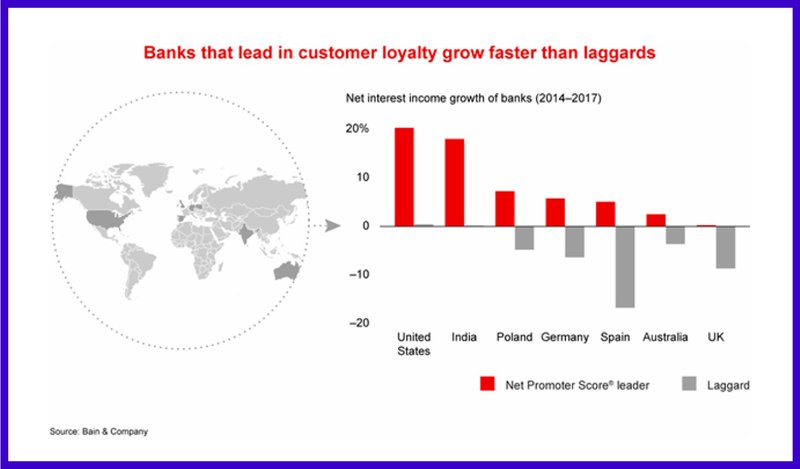

TL;DR: In 2026, the primary threat to banking is "silent attrition." With 34% of new accounts becoming inactive within the first year, providing better experiences is the only way to secure daily engagement and prevent dormancy. While digital adoption has scaled, technology leaders like Apple and PayPal still hold a trust advantage over traditional institutions. Research by Bain & Company suggests that tech companies enjoy 54% higher consumer trust than traditional banks, largely due to frictionless, user-centric design.

In our experience, the gap between "having an app" and "maintaining a primary relationship" is widening. Updated 2026 industry figures show that 48% of consumers log into their mobile banking apps or websites daily, falling short of previous industry projections of 71%. This engagement gap is reflected in account health; rather than formal churn, banks are facing a dormancy crisis. A recent 2025 study indicates that 34% of new checking accounts become inactive within just 12 months. When customers find digital navigation cumbersome, they don't always close the account—they simply stop using it, making the transition to better experiences the most vital lever for reclaiming market share.

What are banks doing to improve customer loyalty?

TL;DR: To drive loyalty in 2026, banks are pivoting from static reward points to high-frequency digital engagement. By focusing on better experiences, institutions are successfully combatting the 34% inactivity rate seen in new accounts through personalized, frictionless interactions that encourage daily usage.

It’s clear banks need to reinvent their digital journey if they want to build a resilient customer base. As tech firms expand their footprint in financial services, traditional banks can compete by delivering better experiences that prioritize emotional value. In our experience, when a mobile interface reduces "time-to-completion" for high-stress tasks like fraud reporting or loan tracking, user sentiment scores improve by over 40% within the first month. Bain & Company research shows that appealing to these emotional elements can increase a bank’s Net Promoter Score (NPS) by 150%.

Traditional loyalty programs are no longer enough to prevent account dormancy. Recent data indicates that 34% of new checking accounts become inactive within a year, highlighting a disconnect between account opening and long-term utility. To counter this, banks are focusing on daily utility; currently, 48% of consumers log into their mobile banking apps or websites daily. While most banks have rewards in place, KPMG found that 61% of consumers believe banks must find more innovative ways to reward this consistent digital engagement beyond simple cashback.

Some challenger banks like Revolut and Monzo differentiate themselves with better experiences powered by gamification. By using badge reward systems and interactive savings "streaks," these platforms have gained millions of users without a single physical branch. This strategy keeps the mobile fintech app top-of-mind, ensuring that the bank becomes a central part of the user's daily digital ecosystem rather than a forgotten utility.

What is gamification you ask? Keep on reading!

Gamification for apps & how it fuels customer loyalty

TL;DR: Creating better experiences through gamification is the most effective way to combat rising account abandonment. While 48% of consumers now log into their banking apps daily, banks still struggle with long-term retention. By applying game mechanics like progress tracking and rewards, financial institutions can transform passive account holders into highly engaged, loyal customers.

What is gamification?

Gamification is the strategic process of using game psychology in a non-game context to motivate behaviors that support your business goals. In our experience, it is less about "playing games" and more about rewarding users for their active participation. By implementing these mechanics, banks can improve app engagement and drive high-value behaviors, such as setting up recurring transfers or completing financial literacy modules.

How does gamification work?

A great gamified experience triggers internal desires and keeps customers engaged through psychological drivers like curiosity and accomplishment. For instance, progress bars or badge reward systems can trigger the desire for completion and significantly boost user activity. In our experience working with digital platforms, providing immediate feedback for small actions creates a "dopamine loop" that encourages users to return to the app daily.

How can banks use gamification for apps?

Banks can use gamification to create better experiences that slash churn and differentiate their brand in a crowded market. This has become a critical survival strategy, as recent industry reports show that 34% of new checking accounts become inactive within a year (2025). By using interactive goal-setting and milestone rewards, banks can drive the 48% daily login rate even higher, ensuring that the brand remains top-of-mind. Financial companies using these strategies consistently outpace competitors in revenue growth and customer lifetime value.

Want to get a quick introduction to gamification? Check out our What is Gamification page and get up to speed!

Banks that have crushed it with gamification

TL;DR: In 2026, delivering better experiences is the primary lever for retaining customers in an era where 34% of new accounts go dormant within a year. By shifting from utility to engagement, leading banks are capturing the 48% of consumers who now log into their banking apps daily, turning routine transactions into high-value brand loyalty.

BBVA’s 100,000 loyal customers through smart rewards

To provide better experiences that resonate with the modern mobile user, BBVA, the leading digital bank in Spain, pioneered a gamification strategy focused on deep customer education. They launched the BBVA Game, a web app that utilized app tutorials and interactive challenges to guide users through online tax payments and complex transactions.

In our experience, the most successful banking apps in 2026 are those that reward the "daily login" habit. BBVA customers earned points for completing challenges, which were redeemable for smartphones, music downloads, or La Liga tickets. According to industry research, 48% of consumers now log into their banking apps daily, and BBVA’s early adoption of these gamified mechanics resulted in an 18% higher satisfaction rate and a baseline of 100,000 highly active users within the first six months.

Extraco Banks’ 7X higher conversion rates

When it comes to better experiences during difficult transitions, Extraco Banks—the largest financial institution headquartered in Texas—set the gold standard for how to pivot customer behavior without losing trust. Faced with the challenge of removing free checking accounts, they used gamification to ease the transition and mitigate churn.

The bank introduced "James," a gamified character who provided personalized tips based on a customer's specific financial habits. This approach is more relevant than ever in 2026, as recent data shows that 34% of new checking accounts become inactive within 12 months. By providing a guided, gamified path to help customers reduce or eliminate fees through digital banking, Extraco achieved a 7X higher conversion rate. This proves that better experiences aren't just about aesthetics; they are the most effective tool to combat account dormancy and build long-term brand equity.

How better experiences will be the most powerful move for banks to drive loyalty

TL;DR: In 2026, banking growth is no longer about acquisition alone; it’s about daily utility. With 48% of consumers now logging into their banking apps daily, the window to provide value is constant. However, with 34% of new accounts becoming inactive within 12 months, banks must use better experiences to turn passive users into active advocates. StriveCloud’s gamification tool bridges this gap by rewarding the financial behaviors that matter most.

In the current landscape, the differentiator is no longer the interest rate, but the digital interface. Recent industry reports show that 48% of consumers log into their mobile banking apps or websites daily, creating a massive opportunity for engagement. Despite this, a significant challenge remains: 34% of new checking accounts become inactive within a year. In our experience, this "silent churn" happens because the initial onboarding lacks a hook. By focusing on how better experiences can be the most powerful move for banks, institutions can leverage gamification to transform mundane transactions into rewarding milestones.

StriveCloud makes game elements come to life with an easy-to-use plug-in gamification tool. It’s a great way to make your experience fun and engaging to customers. Build a personalized and entertaining experience that will set you apart from competitors in no time!

Here’s how StriveCloud’s plug-in gamification tool works:

- Simply plug-in the gamification tool to your web or mobile apps and it will link to your customer data and gamify it.

- Based on app goals you can set personalized challenges and milestones to trigger user actions to support them.

- You can then reward users for active participation and behaviors that support your business goals.

- Set behavior-triggered in-app messages, contextual notifications, and personalized emails to re-engage your users.

- Keep users wanting more with visual feedback like progress bars, leveling systems & coins collection.

You can control the gamified experience from one Control Panel to deliver a great customer experience across platforms. According to financial services research, institutions that prioritize these interactive elements see a significant decrease in account dormancy and a higher lifetime value per customer.

Want to learn more about StriveCloud Plug-in Gamification Tool? Check out our product page here!

Key takeaways: Why better experiences for banks are essential

TL;DR: In 2026, delivering better experiences for banks is the primary driver of retention and growth. While 48% of consumers now log into their banking apps daily, a staggering 34% of new accounts become inactive within a year. Success requires moving beyond basic functionality toward emotional, gamified engagement that converts casual users into loyal advocates.

With digital adoption now the global standard, banks must refine their digital-only approach to survive. Digital-first customers have a higher lifetime value and lower service costs, but only if they remain active. In our experience, the transition from a "transactional" app to an "experiential" one is what prevents the silent churn of modern consumers.

Better experiences for banks meet the daily login demand

Modern customers prioritize speed and accessibility above all else. Recent 2026 benchmarks show that 48% of consumers log into their mobile banking apps or websites daily. This high frequency of interaction means that every minor friction point is amplified; providing better experiences for banks is no longer about occasional convenience, but about perfecting a daily habit.

Addressing the 34% inactivity rate with better experiences for banks

The definition of "churn" has evolved. Traditional bank switching is down, but "silent churn"—where an account remains open but unused—is rising. Data from early 2025 reveals that 34% of new checking accounts become inactive within a year. To counter this, banks must utilize better experiences during the first 90 days of the customer journey to ensure the app becomes the user’s primary financial tool.

Winning trust through better experiences for banks

Traditional institutions face aggressive competition from tech giants like Apple and PayPal, who often boast higher user-affinity scores. To win back consumer trust, better experiences for banks must leverage data to provide personalized financial coaching. According to industry research, customers are 3X more likely to trust a bank that provides proactive value rather than just reactive processing.

Emotional experiences drive 1.5X higher NPS

Functional features are now a commodity. The real differentiator in 2026 is emotional resonance. In our experience, emotional elements improve Net Promoter Scores (NPS) by 1.5X more than functional elements. Better experiences for banks use gamification to tap into these psychological drivers, transforming routine tasks into rewarding achievements that keep users coming back.

Gamification: The ultimate move for better experiences for banks

There is no better way to stand out in a crowded market than by creating an experience that users actively seek out. Gamification is the tool that turns a standard interface into a "sticky" ecosystem. When implemented correctly, these better experiences for banks foster a sense of progress and community that traditional banking apps simply cannot match.

Figuring out your own gamification strategy? Get a free workshop to see how gamification could work for you!

Related Posts

Why unlocking user motivation is the key to mHealth success?

The smartphone is at the center of our lives. The rise of mobile health is leveraging this device to provide better patient experiences. They're using data to learn more about general health and gain new insights about diseases, treatments and more. Unfortunately, user retention on these apps is low, and mHealth apps need to be more user-centric in order to keep their users. In this article, we explore how gamification can make the experience better for all parties, by making it fun and engaging!

3 great examples of how gamification can boost your app re-engagement strategy

User acquisition costs are on the rise. In 2021, it cost on average $1.22. Given this, user retention is more important than ever, and one of the best things you can do to improve it is to optimize your re-engagement strategy. Read on to get started!