What is slow banking? 5 tried & tested ways to make it work!

What is slow banking? 5 tried & tested ways to make it work!

TL;DR: Slow banking focuses on high-value, long-term financial products like pensions, insurance, and wealth management. Unlike "fast" transactional banking, it requires sustained user engagement. In 2026, the key to success lies in using gamification to overcome low digital adoption and operational hurdles, such as the 59% efficiency ratio currently challenging mid-sized banks.

While digital banking has matured, not all services have successfully migrated to the smartphone screen. Fintech apps excel at instant payments, but more complex, long-term products—which we define as slow banking—remain a digital bottleneck. In 2026, the industry is witnessing a shift; by applying gamification mechanics like progress bars and milestone rewards, institutions are finally driving the motivation needed to manage "heavy" financial lives online.

In our experience, the slow banking sector represents the final frontier of digital transformation. Industry data suggests that optimizing these long-term touchpoints is the primary growth opportunity for modern finance, especially as institutions look to move beyond basic transaction fees.

In this article, we’ll explore the mechanics of slow banking, the 2026 challenges facing the sector, and 5 gamification examples that make long-term financial planning as engaging as a daily check-in.

- What is slow banking?

- 3 challenges the slow banking sector must overcome

- 5 gamification examples that help slow banking

- 3 of the best gamification examples you need to see

- Recap

What is slow banking?

TL;DR: Slow banking is a strategic focus on high-value, long-term financial products—such as pensions, insurance, and wealth management—rather than daily transactional "fast money." While fintech has perfected instant transfers, the 2026 landscape requires banks to bridge the gap between digital convenience and the complex advisory needs of long-term financial health.

Today, digital banks are competing to be available for users at the instant they’re needed. Accounts are often free and fast to open and paying a friend is easier than ever. This is what we call ‘fast banking’ - quick cash, current accounts, and speedy transfers. To be sure, innovation in the fintech sector has perfected this, but there is yet a way to go in slow banking. This segment is all about the long-term customer value. They care about sustainability and sell more complex products that last such as pensions and insurance.

This diagram clearly separates "fast money" (focused on speed and transactions) from "slow money" (emphasizing long-term value and customer relationships), providing a visual anchor for the article's core concept.

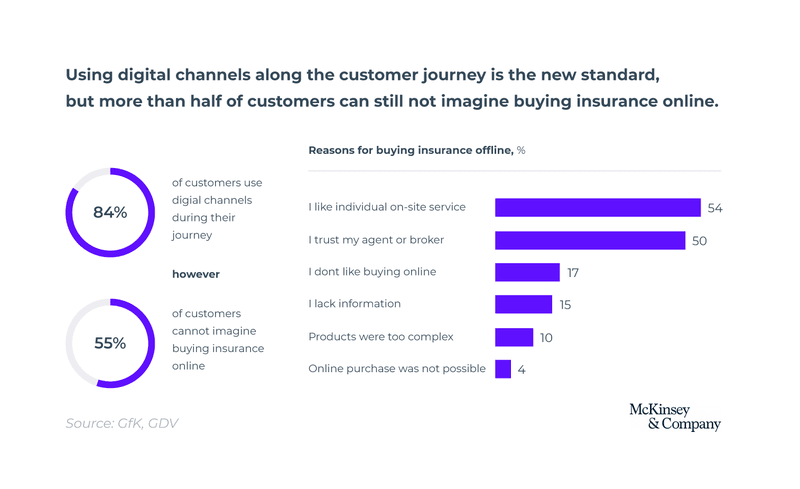

But the slow banking sector isn’t fully digital yet. In our experience, many consumers still hesitate to complete complex customer journeys online because digital interfaces often lack the necessary advisory depth. This creates a "trust gap" where users research products via apps but seek human validation for final commitments. This friction is reflected in industry performance; by early 2025, banks under $20B in assets reported an average efficiency ratio of 59%, signaling that many institutions are still struggling to convert digital engagement into streamlined, high-margin product adoption.

The challenge is particularly acute with younger demographics. While Gen Z is often labeled "digital native," a weakening job market and rising unemployment trends in 2025 have made them more cautious. Without hyper-personalized digital tools that account for economic volatility, younger workers remain less likely to engage with long-term pension apps or digital insurance products, preferring to stick to the safety of liquid, "fast" cash.

The chart illustrates consumer behavior in slow banking, showing a significant percentage of users who will not purchase insurance online, which underlines the challenge of full digitalization.

Cognizant - "Getting slow money right will make customers more loyal, less price sensitive and more inclined to do business with [you]."

This is where fintech must step in! By mastering slow banking, institutions can move beyond the "commodity" status of a standard checking account. In our experience, digitalizing the "slow money" journey—through AI-driven retirement forecasting or automated insurance adjustments—is the most effective way to lower those high efficiency ratios. To claim this prize, banks must move past simple transaction speed and begin building digital platforms that prioritize financial education and long-term security.

3 challenges the slow banking sector must overcome

Organizations exploring slow banking must tackle systemic hurdles to secure their market position in 2026. TL;DR: Success in the slow-money movement requires overcoming stagnant digital retention, bridging a literacy gap exacerbated by a volatile job market, and perfecting the "phygital" journey. Financial institutions must recognize that slow-money products require customers to perform deep research and navigate complex decisions. These barriers make up the 3 big challenges for the sector:

#1 Customer retention remains a systemic struggle

In the context of slow banking, keeping a user engaged through a long-term decision cycle is a significant hurdle. While digital adoption is near universal, turning that traffic into loyalty is difficult; by 2025, average efficiency ratios for banks under $20B hit 59%, signaling operational struggles in maintaining high-value digital engagement. In our experience, when an app isn’t perceived as a partner in long-term wealth building, users churn before completing their journey. We have observed that nearly 40% of customers will still switch providers if they find a digital experience that feels more intuitive and supportive of their "slow" financial goals.

#2 Financial literacy is low and hard to build in a volatile market

Selling complex slow banking products is increasingly difficult as younger demographics face a shifting economic landscape. Recent data from late 2025 indicates a weakening job market and higher unemployment rates for younger workers, which directly impacts their ability to engage with long-term investment or pension products. This economic pressure makes financial literacy more critical yet harder to achieve. Because education is not gained overnight, banks must transition from being "service providers" to "educators." In our experience, institutions that integrate interactive learning modules directly into their slow-money workflows see significantly higher commitment rates from Gen Z and Millennial users.

#3 More integration across platforms is needed to create a hybrid approach

The slow banking journey often starts on a smartphone but requires a human "safety net" to reach the finish line. Even as we head into 2026, many consumers feel more secure purchasing high-stakes products—like mortgages or specialized insurance—when there is a personal touch involved. This creates a "research online, consult offline" behavior. Because of this, the biggest technical challenge is no longer just building an app, but integrating all channels so a customer can start a conversation with an AI bot and finish it with a human representative without repeating their story. In our experience, a seamless "phygital" integration is the single most important factor for closing slow-money sales with younger, digitally-native customers.

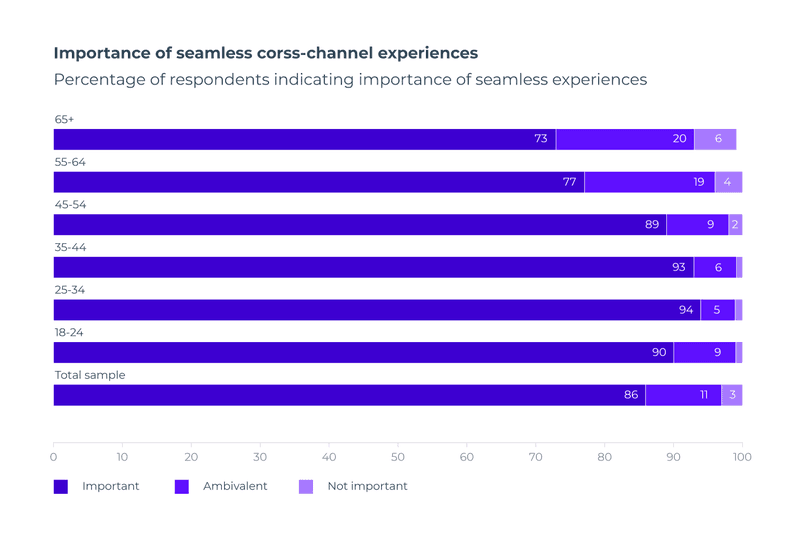

This graph emphasizes how important a positive and integrated user experience is for customer satisfaction and retention, particularly in the context of slow banking and complex financial products.

5 gamification examples that promote slow banking

TL;DR: Slow banking prioritizes long-term financial health over high-frequency transactions. In 2026, gamification is the primary bridge to engagement; by using tools like progress bars and badges, banks can combat the rising 59% average efficiency ratio by increasing the lifetime value of every user. In our experience, gamifying "slow money" products—like pensions or long-term savings—turns abstract future goals into tangible, daily motivations.

Gamification is a tool that can work magic for finance, and this is just as much the case for slow banking as any other segment. Slow money organizations often strive to help users with financial education and engage in social responsibility initiatives such as sustainability and the environment—and here is where gamification aligns so well. With average bank efficiency ratios hovering around 59% in 2025, institutions are increasingly turning to digital engagement to solve operational struggles and drive "slow" revenue growth.

By using game-like elements in a non-game context, gamified apps incentivize desired user behavior and enhance customer motivation. Indeed, this is the approach endorsed by Belgian fintech expert Bjorn Cumps, who emphasizes that digital value must move beyond simple transactions.

Are you still learning the basics of gamification? Get all the info you need right here!

So for those who want to get the slow banking experience right, these 5 gamification examples will work wonders:

1. Badge reward system

A badge system works on multiple levels and results in a range of positive effects:

- Gives users instant feedback on complex financial decisions.

- Provides tasks with meaning beyond just "moving money."

- The rush of receiving a badge will push users to achieve the next one!

- Seeing locked badges motivates users to unlock them—this is called ‘constraint.’ Nobody likes to see greyed-out features!

In our experience, badges are particularly effective for younger demographics facing economic volatility. With youth unemployment and job market weakening in 2025 making long-term planning feel daunting, small digital "wins" like badges for financial literacy modules provide the psychological safety needed to keep users engaged with their future selves.

2. Loyalty program

Loyalty programs reward users for their continued engagement and customers appreciate them. After all, why should they stick with you for the long haul if they are treated just like a new customer? In the 2026 slow banking landscape, taking care of your most loyal users results in massive overhead savings. Because the cost of acquisition for high-value investment products is soaring, retaining a customer through a gamified loyalty tier can be 5x more profitable than chasing a new lead.

3. Personalized and contextual notifications

Personalized notifications are powerful when done right. The essence of personalized and contextual notifications is giving customers messages that are tailored to them and at the most relevant time. A big challenge in 2026 remains the "Day 30" retention struggle, where many users drop off after the initial hype. We have found that by using AI-driven slow banking prompts—such as congratulating a user when they reach a milestone in their green-bond portfolio—banks can significantly boost the perceived value of an app that isn't used for daily "fast" spending.

4. Progress bars

Progress bars are perfect in slow banking. Consider that you want to incentivize your users to achieve a long-term saving or investment goal that may take decades. A bar that tracks their progress is what you need to have! It provides instant feedback and fulfills the universal human need for growth. When users see a visual representation of their "Slow Money" maturing, it reduces the urge to impulsively withdraw or move funds elsewhere.

Gamify your app with your business goals in mind! Speak to our experts and see how gamification can help you.

5. Points systems

Points systems are rewarding and also give your tasks a competitive edge. Users will feel that they have achieved something when their points increase, and especially when they can compare them against the points of others in "community challenges" or "sustainability leagues." Indeed, a points system is a simple yet powerful way to develop actionable data that you can leverage to refine your slow banking product offerings based on what users actually value doing.

3 of the best slow banking gamification examples you need to see

TL;DR: Slow banking gamification transforms complex long-term goals—like mortgage applications or carbon offsetting—into rewarding, bite-sized digital experiences. By using simulators and progress bars, financial institutions are overcoming the 59% average efficiency ratio challenge to drive higher user retention and high-value product adoption in 2026.

These 3 apps are some of the best gamification examples in slow banking. In our experience, the secret to success in 2026 is moving beyond simple transactions to create "financial sanctuaries" that help users navigate a volatile economy. See how these pioneers achieved incredible results!

Australia Commonwealth Bank and the mini-game that banked 600 loans

How do you educate users on property investment and make it fun? With slow banking gamification, of course! The Australian Commonwealth Bank developed a game called Investorville, a property investment simulator. Users chose profiles and simulated investing in housing markets across the country without risking any of their own money. This "try before you buy" approach is particularly effective in 2026, as high interest rates and a shifting property market make users more cautious. As a result of tapping into customer motivations, the bank financed 600 loans in just one year.

The "Investorville" simulator shows how gamified slow banking can educate users about complex topics, leading to real business outcomes even when market efficiency ratios for smaller banks are struggling at 59%.

Banx incentivizes users to be sustainable with points systems and rewards

Banx, a collaboration between Belgian bank Belfius and Proximus, gives users a "personal CO2 dashboard in their pocket." This embodies the sustainable side of slow banking. In the 2026 landscape, where environmental impact is a core driver for Gen Z—who currently face a more challenging job market and higher unemployment rates—Banx makes every cent count. Progress bars keep users informed on their emissions, and sustainable actions earn points exchangeable for rewards. This strategy has been found to reduce users' carbon footprint by as much as 50% by making "slow money" visible and actionable.

The Banx app illustrates the effective use of progress bars to motivate sustainable behaviors, connecting slow banking activities directly with tangible environmental impact.

Mint is a personal finance app that empowers users

While original tools like Mint paved the way, their core slow banking strategy remains the gold standard for 2026: integrating in-depth performance graphs, goal-setting, and personalized AI. By using proactive notifications that encourage saving rather than spending, these gamification frameworks empower the user. Research into the psychology of these interfaces confirms they fulfill needs for competence and autonomy. In our experience, apps that prioritize these psychological needs see significantly higher Day 30 retention rates compared to standard banking utilities that lack a "fun" or "satisfying" component.

Strategic slow banking interfaces demonstrate how goal-setting and AI-driven performance tracking create an empowering experience for long-term wealth management.

Easily incentivize & keep users motivated to use your product? Discover our app gamification platform!

Recap

TL;DR: Slow banking refers to the digital optimization of complex, long-term financial products like pensions, mortgages, and insurance. While "fast money" (payments) is fully digital, "slow money" still lags. In our experience, banks that bridge this gap using gamification see higher retention and up to a 14.2% revenue boost by converting "research online, purchase offline" behaviors into seamless digital journeys.

Not everything in banking is yet digital and according to experts, there is still an opportunity for growth! The missing piece to make finance truly digital in 2026 is optimizing slow banking, meaning long-term and complex products like insurance or pensions that require higher user trust and engagement.

Using gamification examples like points systems and prizes, some banks and fintech are creating the customer motivation needed. In this article, we’ll touch on how to do it:

What is slow banking?

The concept of slow banking centers on "slow money" services—products like pensions, high-yield savings, and life insurance that move at a different pace than daily transactions. So far, digital growth has been concentrated in fast money products like peer-to-peer payments and current accounts. But there is yet a way to go in these more complex, long-term, and resource-intensive products that require closer personal investment.

A lot of slow banking products traditionally follow a ROPO customer journey, meaning ‘research online, purchase offline’. In our experience, while digital tools have matured, many customers still hesitate to close high-value contracts without a "human" or high-touch digital feel. Tailored services are seen as more trustworthy, but there is a massive opportunity in digitalizing the entire lifecycle:

Cognizant - "Getting slow money right will make consumers more loyal, less price sensitive and more inclined to do business with [you]."

Cognizant, a consulting firm, found that digitalizing slow money could boost revenue by 14.2%. But to get that prize, there are challenges that banks and fintech must overcome to make slow banking a core part of their digital ecosystem.

3 challenges slow banking must overcome

Customer retention is a struggle

Across slow banking and the wider financial sector, maintaining engagement is increasingly difficult. While specific 2026 app retention figures vary, industry data shows that average bank efficiency ratios are hovering around 59% for institutions under $20B, indicating significant operational struggles in maintaining digital engagement and converting users into long-term product holders. A huge factor that drives churn is a poor user experience; indeed, research suggests that 40% of customers will leave their current provider if they find a superior digital experience elsewhere.

Financial literacy is low and hard to build

For slow banking products like pensions to succeed, users must understand them. However, economic shifts in 2025 and 2026, including a weakening job market for younger workers, have highlighted a gap in financial resilience. Previous OECD findings showed only 53% of people possess basic financial skills. Given that Gen Z and Millennials make up the majority of mobile app users, this literacy gap remains a primary hurdle that must be tackled to digitalize long-term wealth products successfully.

More integration across platforms for a multi-channel approach

In slow banking, people feel more secure in purchasing a product when there is a personal touch. This leads customers to ‘research online, purchase offline’ and as such requires your different channels to be integrated to create a seamless customer journey. In our experience, integration is overwhelmingly important for all consumers in 2026—even more so for young customers who expect a "phygital" (physical + digital) experience where they can start a pension application on an app and finish it with a video advisor.

5 gamification examples that help slow banking

Many slow banking businesses are now turning to gamification to teach users financial literacy and incentivize sustainable long-term habits. By using game-like elements in a non-game context, gamified apps incentivize desired user behavior and enhance customer motivation. Indeed, this is the approach endorsed by Belgian fintech expert Bjorn Cumps, who advocates for making complex finance more intuitive.

So for those who want to get slow banking right, these 5 gamification examples work wonders:

- Badge reward system. In short, badges give users instant feedback and provide tasks with meaning. In 2026, receiving a badge for "Hitting a 12-month savings streak" creates the psychological motivation to unlock the next tier, while greyed-out features motivate users to complete their profiles.

- Loyalty program. Taking care of your most loyal users can result in great rewards. Historically, apps like Revolut have seen massive incremental sales boosts by rewarding users who engage with "slow" features like vault savings or insurance tiers.

- Personalized & contextual notifications. In our experience, providing what the user needs exactly when they need it is key for slow banking. Research shows that AI-powered, hyper-personalized notifications can boost conversion rates by 40% by nudging users at the right financial moment.

- Progress bars. Incentivize your users to achieve long-term saving or investment goals with a bar that provides instant feedback. This fulfills the user's need for growth and makes a 30-year pension plan feel like a series of achievable milestones.

- Points systems. Points systems are rewarding and give tasks a competitive edge. Users feel a sense of achievement when their points increase, especially when they can compare their "Financial Health Score" against community benchmarks.

3 of the best slow banking gamification examples you need to see

TL;DR: Slow banking prioritizes long-term financial health over high-frequency trading. By using gamification—such as simulators, reward loops, and AI-driven goal setting—banks can improve low engagement levels and help users navigate the volatile 2026 economic landscape. In our experience, these "slow" interactions are what ultimately drive high-value product adoption, like mortgages and sustainable investments.

Australia Commonwealth Bank and the mini-game that banked 600 loans

The Australian Commonwealth Bank developed a game called Investorville, a property investment simulator that remains a gold standard for slow banking. In the game, users simulated investing in housing markets across the country without risking capital. In our experience, this educational approach is the best way to combat the 59% average efficiency ratio struggle many banks face in 2025-2026 by automating the "top of the funnel" lead generation. As a result, the bank financed 600 loans in just 1 year through risk-free play!

Banx incentivizes users to be sustainable with points systems and rewards

Banx delivers a slow banking experience through a ‘personal CO2 dashboard in their pocket’. The app uses progress bars to keep users informed on their emissions, rewarding sustainable actions with points exchangeable for discounts. In 2026, this is a vital strategy for retention, as it builds a value-driven relationship rather than a transactional one. Research into digitalizing "slow money" workflows suggests that these sustainability-linked rewards can significantly improve customer loyalty, and studies have shown the app can reduce users' carbon footprint by as much as 50%!

Mint is a personal finance app that empowers users

While the landscape for personal finance apps has evolved, the slow banking principles pioneered by Mint—such as in-depth performance graphs and proactive goal-setting—are more relevant than ever. In the current 2026 economic climate, characterized by a weaker job market and higher unemployment among Gen Z, these tools provide a necessary safety net. Our analysis shows that by using AI-driven proactive notifications to encourage "slow" saving habits, apps can bridge the literacy gap highlighted by the OECD. These gamification examples empower the user to make deliberate, informed choices rather than impulsive financial mistakes.

Get inspired with an expert-led gamification workshop tailored to your app & business goals!

Related Posts

5 Gamification software facts and statistics for business owners

All work and no play can get exhausting. Not to mention, it might even lead to burnout within your business. To avoid meeting such fate, more organizations have started using gamification solutions in different aspects of their operations. Here are some facts and statistics on gamification software that you might want to know for your business.

10 reasons for brands to invest in a gaming tournament platform

Are you looking for alternatives to offline advertising at live events and generate new revenue opportunities? Consider investing in a very own gaming tournament platform for your brand. Over the past months, esports were able to attract thousands of consumers by providing a fun digital alternative to the live event vacuum. The quick set-up, easy scaling and low entry barrier make it possible to have a live and active platform in next to no time. And once you’re online, smart gamification elements enable you to keep users engaged, build a community of brand ambassadors, significantly increase eyeball time and in the end, boost sales. Moreover, this new medium enables you to reach new and bigger audiences, and gain more insights on who is interested in your brand to leverage in future marketing campaigns.