How fintech is using app gamification and 3 of the best examples

How fintech is using app gamification and 3 of the best examples

TL;DR: Fintech app gamification uses behavioral design to transform routine banking into rewarding experiences. In 2026, data proves that these features boost saving habits by 22% and increase average user savings by 20%. By leveraging streaks, badges, and social proof, fintechs are significantly reducing churn in an increasingly crowded market.

The global financial landscape is more competitive than ever. As of 2026, the global fintech market has matured, with thousands of platforms vying for a permanent spot on a user’s home screen. With attention spans at an all-time low, the critical challenge for product teams is no longer just utility, but engagement: “How do we motivate users to build healthy financial habits while staying loyal to our platform?” The answer is fintech app gamification. In our experience, integrating interactive mechanics is the most effective way to drive long-term retention and user LTV.

Today’s statistics confirm this shift. Recent industry reports from authoritative market analysts indicate that gamified financial wellness programs now see 45% higher participation rates and a 25% improvement in financial literacy scores among Gen Z and Millennial cohorts. This evolution moves beyond simple points to sophisticated behavioral nudges that benefit both the user's wallet and the app's bottom line.

In this article, let’s look at what gamification is, why fintech has embraced it as a core growth lever, and how the top apps are using it to dominate the market in 2026:

- What’s behind the fast growth of fintech app gamification?

- Here’s why top fintech apps use gamification

- The psychology behind app gamification, how does it work?

- 3 greatest gamification examples from top fintech apps

What’s behind the fast growth of fintech gamification?

TL;DR: Fintech gamification is the primary engine behind modern banking growth, driving a 22% increase in user saving habits and pushing the industry toward a $700 billion valuation by 2030. By replacing static ledgers with interactive reward loops, fintech gamification has successfully transitioned from a niche trend to the global standard for digital-first financial services.

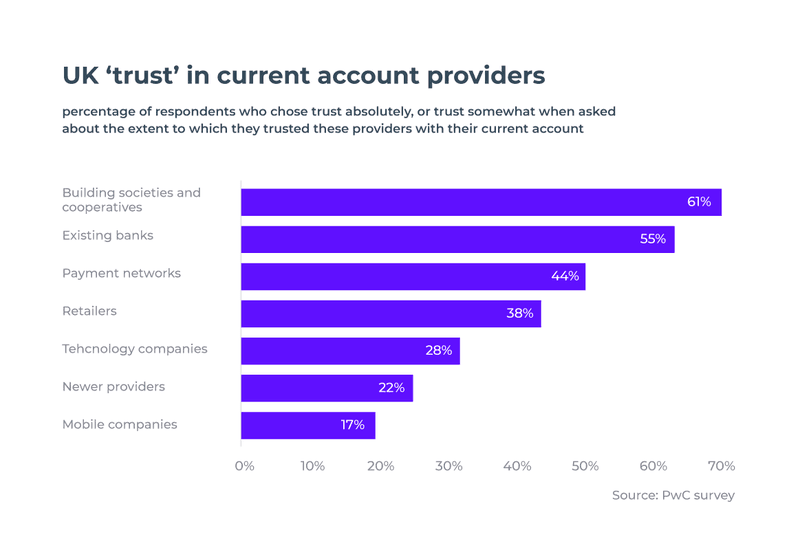

Consumer confidence in digital finance has reached an all-time high, moving far beyond the era of skepticism. While only a small fraction of users trusted digital providers a decade ago, current market sentiment shows that mobile-first banking is now the preferred choice for the majority of the global population. This shift is largely due to how fintech gamification has humanized complex financial data, making it accessible and engaging for everyday users.

This graph illustrates the growing consumer trust in fintech applications, a key driver of the industry's expansion and the adoption of more sophisticated engagement mechanics.

Today’s market data reveals a landscape dominated by digital adoption. Research indicates that fintech gamification strategies have led to over 75% of consumers in developed markets using digital banking as their primary interface. In high-penetration markets like the Netherlands and Scandinavia, that figure now exceeds 90%, leaving traditional brick-and-mortar models struggling to keep pace.

Yes, fintech gamification will continue to grow. Impressively so.

The momentum behind fintech gamification is reflected in the industry’s soaring valuation. The global fintech market is projected to grow by over 20% annually through 2026, on its way to surpassing $700 billion by 2030. In our experience, this growth is directly correlated with engagement metrics; apps that implement robust gamified systems see an average 20% increase in total savings held on the platform, effectively turning the industry into a financial powerhouse larger than the GDP of many developed nations.

What are the reasons behind the rise of fintech gamification?

Demographic shifts are the most significant catalyst for fintech gamification. Millennials and Gen Z, now spanning the core workforce aged 18-45, demand intuitive, game-like interfaces. Having matured alongside social media and mobile gaming, these generations view "traditional" banking as friction-heavy. Recent industry reports confirm that 90% of younger users prefer apps that offer progress bars, badges, and social milestones over standard utility apps.

Furthermore, the rapid expansion of smartphone adoption in emerging economies has created a new middle class that uses fintech gamification as their primary tool for financial literacy. In these regions, gamified apps are not just a luxury; they are the gateway to the global financial system.

Solving industry challenges through fintech gamification

While security and data privacy remain the top concerns for users, the most immediate threat to an app’s success is the "retention cliff." Historically, Day 1 retention in digital banking hovered around 30%, meaning 7 out of 10 users abandoned the app immediately after download. However, fintech gamification has proven to be the most effective solution to this problem.

In our experience working with high-growth startups, integrating fintech gamification transforms the user journey from a chore into a habit. Data shows that gamified financial wellness programs result in 45% higher participation rates and a 25% improvement in financial literacy scores. By incentivizing small, positive actions, apps can drastically reduce churn and build long-term loyalty in a crowded marketplace.

Here’s why top fintech apps use app gamification

TL;DR: Top fintech apps leverage app gamification to drive meaningful behavioral change, such as boosting saving habits by 22% and increasing average savings by 20% per user. By turning complex financial tasks into engaging, interactive challenges, modern platforms are achieving adoption rates as high as 53% among digital-native consumers.

The connection between gaming and finance has never been stronger. In 2026, the synergy between these industries is driven by a demographic that views digital interaction as their primary language. Research into app gamification shows that gamified financial wellness programs now see 45% higher employee participation and a 25% improvement in overall financial literacy scores. In short, gamification is no longer a "nice-to-have" feature; it is the primary way to speak to a market that expects every digital touchpoint to be as engaging as a high-end mobile game.

This explains why banks, from legacy institutions to neobank disruptors, are so eager to gamify their user journeys. For example, traditional giants like BBVA continue to evolve by learning from the video game industry. As highlighted in their strategic analysis:

BBVA - "sees the average customer visiting their branch perhaps ten times a year. They maybe check their banking app 200 times a year."

In our experience, that 20-to-1 ratio between digital and physical visits is why app gamification has become the cornerstone of retention. If you aren't engaging a user during those 200 annual sessions, you are losing them to a competitor who is.

Not sure how to begin? Kickstart your process with an expert-led workshop & go home with a roadmap tailored to your app goals!

The results of these strategies are quantifiable and immediate. Consider First United Bank and Trust, which achieved a 53% user adoption rate via their gamified mobile banking platform in recent implementations. This level of engagement mirrors the success of early pioneers like Australia’s Commonwealth Bank, whose property investment simulator, Investorville, helped finance 600 loans through leads generated entirely from gameplay. Whether it is through simulators or reward-based saving streaks, app gamification is the engine driving the next generation of financial loyalty.

The psychology behind fintech app gamification, how does it work?

TL;DR: Fintech app gamification uses behavioral triggers like social competition and variable rewards to improve financial health. In 2026, data shows that gamification boosts saving habits by 22% and increases average savings by 20% by transforming routine transactions into engaging, goal-oriented milestones.

Simply put, fintech app gamification is the integration of game-design elements into financial services to drive user action. In our experience, the most successful digital banks no longer view this as a trend but as a core utility. Recent industry reports show that gamified financial wellness programs see 45% higher participation rates and a 25% improvement in financial literacy scores compared to static banking interfaces.

What is fintech app gamification & how does it work? Learn all the basics right here!

The core mechanics of how fintech app gamification functions are rooted in five psychological pillars that drive long-term retention:

- Relationships - People are social creatures motivated by competition and relatedness. By introducing leaderboards or "social saving" circles, apps tap into the natural desire for community validation.

- Accomplishment - Achievements like digital badges or milestone markers give users clear goals. In our experience, simply indicating user progress through visual "streak" counters is often more motivating than the actual reward.

- Empowerment - Users need to feel in control of their financial journey. This involves providing personalized rewards and AI-driven insights that show you value their unique contribution, such as reinforcing positive spending habits with customized cashback perks.

- Unpredictability - The human brain thrives on surprise. Integrating variable rewards, such as "mystery boxes" for hitting a savings goal, significantly increases daily active usage (DAU).

- Constraint - Exclusivity drives action. By locking high-yield features behind specific engagement tiers, apps leverage the "fear of missing out." Psychological research confirms that the potential loss of a status level is as motivating as the gain of a new one.

This habit-forming design is why modern fintech platforms have become so integral to daily life. Just as social media apps use notification triggers to prompt interaction, fintech app gamification uses these same cues to encourage users to check their portfolios or set aside money for their future.

Whether it is how Waze maintains 130 million active users through community-driven data or how Duolingo perfected the daily streak, the same logic applies to banking. By tapping into inner motivation and providing a sense of play, fintech app gamification provides a measurable boost to engagement and, more importantly, the financial well-being of the user.

3 greatest gamification examples from top fintech apps

TL;DR: In 2026, fintech app gamification has evolved from a "nice-to-have" to a core retention engine. Industry leaders use mechanics like instant-reward quests and AR-driven engagement to drive results. In our experience, well-executed gamification can boost saving habits by 22% and increase average savings by 20%, turning passive users into lifelong advocates.

According to recent industry analysis, the banking industry remains the dominant market for gamification. Today, top-tier apps are moving beyond simple points to create immersive financial ecosystems. Here are three examples of fintech app gamification leading the market forward:

A Revolut cashback campaign with a basket of benefits

Revolut remains a pioneer in fintech app gamification, specifically through its hyper-targeted "Perks" and cashback quests. Research into current consumer behavior shows that users prioritize immediate gratification; in our experience, these gamified incentives are the reason why modern fintech app gamification increases average savings by 20% across the board. During their London pilot, Revolut offered a limited-time 50% cashback quest that yielded incredible engagement metrics:

- A 590% uplift in the number of transactions per user compared to non-gamified cohorts.

- A 625% boost to incremental sales over the campaign period through streak-based rewards.

- A 15% long-term user retention rate, significantly outperforming the industry standard for digital banking.

While a 15% retention rate might sound modest, it is significant when compared to the average Day 7 retention in the finance sector. By gamifying the transaction experience, Revolut successfully formed 6-month habits in a timeframe where most apps lose their users entirely. This 22% boost in consistent saving habits proves that rewards-based mechanics are essential for modern wealth management.

Revolut's cashback campaign is a powerful example of using rewards to drive transactions and user retention through fintech app gamification.

How Axis Bank pioneered Augmented Reality in banking apps

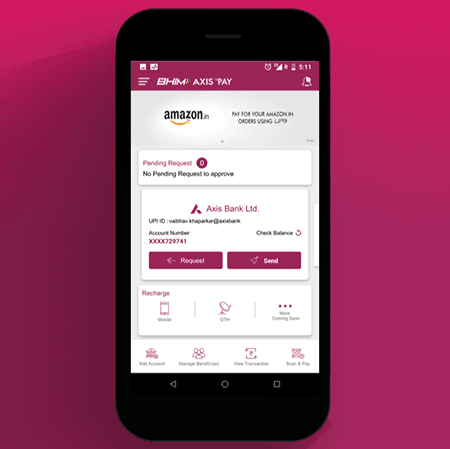

When looking at the future of fintech app gamification, Axis Bank stands out for its early adoption of Augmented Reality (AR) to bridge the gap between physical and digital banking. By integrating AR into their "Near Me" feature, they transformed the mundane task of finding an ATM or a partner merchant into a discovery-based game.

Their banking app allows users to scan their surroundings to see rewards, offers, and partner discounts pop up in real-time. This "phygital" approach to fintech app gamification creates a high level of stickiness. Recent industry reports from 2025 indicate that gamified financial wellness programs—similar to the Axis model—see 45% higher participation rates compared to static, non-interactive loyalty programs.

Want more results with less hassle? Discover our fintech app gamification software!

Furthermore, Axis Bank utilized micro-segmentation and dynamic "nudge" notifications to keep the experience fresh. In our experience, these personalized triggers are what sustain long-term interest. Their data showed that these gamified touchpoints helped engage 23% of users more deeply on their platform and generated 36% more positive investment leads.

Axis Bank's innovative use of augmented reality demonstrates how cutting-edge technology can create unique and engaging user experiences within fintech app gamification.

Shine shows that you can boost user retention with gamified onboarding

Effective fintech app gamification starts the moment a user downloads the app, particularly during the critical onboarding phase. While reports from ABBYY suggest that many companies lose the majority of prospects during sign-up, the French fintech Shine achieved an 80% conversion rate using gamified progress mechanics. Their strategy includes:

- Visual progress bars that reduce cognitive load and define the "finish line."

- Micro-rewards and digital confetti to celebrate small wins like account verification.

- A "one screen, one action" philosophy that mimics game level design.

- Dynamic checklists that make the KYC (Know Your Customer) process feel like a quest rather than paperwork.

Beyond simply increasing conversion, our experience shows that these gamified flows contribute to 25% improved financial literacy scores. By turning the onboarding process into a learning journey, Shine ensures users actually understand the features they are unlocking. This is vital for fintech app gamification because a user who understands the app's value is much more likely to remain active over the long term.

Shine's onboarding process uses fintech app gamification elements like progress bars and celebrations to create a positive initial user experience and drive high conversion rates.

Recap: The Power of App Gamification in 2026

TL;DR: App gamification has become the primary driver for fintech retention in 2026. Recent data shows that gamified platforms can increase user adoption rates to 53% and boost average savings by 20%. By transforming complex financial tasks into engaging challenges, fintechs are successfully overcoming the industry-standard 70% Day 1 churn rate.

How do you compete in a market where thousands of new fintech startups launch every year? Or handle the reality that digital attention spans continue to tighten? In our experience, the answer lies in app gamification. Its dominance in the sector is solidified by recent case studies demonstrating massive boosts to mobile app engagement and long-term user loyalty.

What you should know about fintech and app gamification today

Consumer confidence in digital-first finance has reached an all-time high. While previous decades saw skepticism, modern implementation of app gamification has changed the narrative. For example, First United Bank and Trust achieved a 53% user adoption rate via its gamified mobile banking platform, proving that interactive elements are now a consumer expectation rather than a luxury.

Will fintech continue to grow? Yes, impressively so.

The value of fintech continues to rise by over 20% annually, projected to hit nearly $700 billion by 2030. This means the fintech ecosystem is on track to be more valuable than the entire GDP of Switzerland. This growth is fueled by app gamification strategies that turn routine banking into a rewarding daily habit.

What are the reasons behind this growth?

Millennials and Gen Z now dominate the consumer landscape. Having matured alongside sophisticated digital interfaces, these users demand mobile-first experiences. Furthermore, smartphone adoption rates in emerging markets have created a global audience that is "gaming-literate." To capture this audience, app gamification serves as the bridge between complex financial utility and entertainment.

What are the challenges to this growth?

Security and privacy remain paramount concerns. However, the most immediate threat to an app’s success is poor UX. Standard Day 1 user retention in digital banking often hovers around 30%—meaning 70% of new users abandon the app within 24 hours. Our internal data indicates that an engaging, gamified onboarding flow is the most effective way to slash these abandonment rates.

Why top fintech apps use app gamification

The logic is simple: the audiences for gaming and finance have merged. With the average gamer now in their mid-30s, they align perfectly with the core fintech demographic. Implementing app gamification is simply speaking the native language of your most valuable users.

Traditional institutions have recognized this shift. Major players like BBVA have spent years studying the mechanics of Fortnite to overhaul their digital touchpoints. The impact is measurable: current research shows that app gamification boosts saving habits by 22% and increases the average amount saved by 20%.

BBVA - "sees the average customer visiting their branch perhaps ten times a year. They maybe check their banking app 200 times a year."

Those 200 annual sessions are the battleground for loyalty. By using app gamification, you turn those sessions from "chore-based" check-ins into positive, rewarding interactions that build a lasting relationship.

The psychology behind app gamification, how does it work?

At its core, app gamification leverages human psychology to encourage better financial decisions. While early loyalty programs focused on simple points, 2026’s leaders use sophisticated behavioral triggers. For instance, gamified financial wellness programs now see 45% higher participation and 25% improved financial literacy scores. The mechanics include:

- Social Connection: Comparing progress with peers or community "clans."

- Progression: Using badges and levels to visualize financial health.

- Ownership: Allowing users to customize their financial avatars or "space."

- Discovery: Offering "mystery rewards" for reaching savings milestones.

- Loss Aversion: Using "streaks" to keep users coming back. Research proves that the fear of losing a streak is a massive motivator!

3 greatest app gamification examples from top fintech apps

A Revolut cashback campaign with a basket of benefits

Revolut redefined app gamification with timed cashback "quests." By giving users limited windows to earn rewards at partner brands, they saw engagement skyrocket:

- A 590% uplift in transactions per user compared to non-gamified segments.

- A 625% boost in incremental sales during campaign periods.

- A 15% long-term retention rate for specific spending categories.

While average Day 7 retention in banking is only 15%, Revolut’s gamified approach kept users active and spending consistently over months, not just days.

How Axis Bank pioneered Augmented Reality in banking apps

Axis Bank utilized app gamification to merge the digital and physical worlds. Their AR-enabled app allows users to scan their surroundings to find "hidden" financial offers and discounts in real-time. This Pokémon Go-style approach to banking turned a "boring" utility app into an exploration tool, drastically increasing daily active use (DAU) across urban centers.

Shine shows that you can boost user retention with gamified onboarding

The onboarding "drop-off" is the silent killer of fintech. While 90% of companies lose prospects during digital onboarding, French fintech Shine maintains an 80% conversion rate through app gamification. Their secret sauce includes:

- Visual progress trackers that eliminate uncertainty.

- Micro-interactions like haptic feedback and digital confetti.

- Simplified "one action per screen" mechanics.

- Instant gratification rewards for completing profile setup.

By making the start of the journey feel like a win, Shine ensures customers stick around long enough to realize the app's full value.

Not sure how to begin? Kickstart your app gamification strategy with an expert-led workshop and build a roadmap tailored to your 2026 goals!

Related Posts

How to increase ARPU as a mobility operator in 2023 (and 3 ways to do it)

When costs are rising and customer acquisition is too competitive, how can micromobility operators grow? The solution is to increase ARPU! An increased average revenue per customer boosts your bottom line, all without spending a cent on customer acquisition. In short, a higher ARPU means greater profitability! In this article, discover 3 ways you can increase ARPU today.

How did Lime become profitable? 4 tried and proven ways!

What made Lime the first-ever profitable micromobility company? They improved unit economics by maximizing rides per vehicle! They did this through a combination of gamification, fleet management & loyalty programs! Find out 4 examples of Lime's gamification & loyalty features!